What is the Countinghouse Fund

Countinghouse Fund is an established foreign exchange hedge fund that uses code algorithms and math techniques to force profit from volatility and movement in the market. We raise capital for new funds to apply our existing techniques to the world of cryptocurrency, which shows greater volatility than fiat currency exchange.

One of the most obvious reasons why ordinary people do not enter this market is because they do not understand it! When we talk about making money with the exchange of assets, whether it's stocks, bonds, like currency pairs, there is a common factor in this operation and that is that they are made with fiat currency. ( dollars, euros, etc ) When the operation is done at home exchange of cryptocurrency, this parameter is changed, because to buy most of the assets, we need Bitcoin in majority or Ethereum as default. In order not to make the article more complicated, say that trading is done by exchanging BTC for other altcoins and in this price difference is a profit or loss.

Countinghouse MISSION

Our goal is to maximize investor returns through mathematical risk management and application of algorithmic trading methods to the crypto currency market, and to further legitimize blockchain as an alternative and viable investment of the currency

MAIN BENEFITS

- With over a decade of experience in trading in foreign exchange markets, both manually and algorithmically, our team has a good position to transfer these skills to crypto currency exchange.

- All investor capital will go directly into our investment account due to the fact that we are a well-established business with infrastructure and products that have been tested and functioning

- Our algorithmic trading model has resulted in strong success in fiat currency exchange across Countinghouse presence, and our updated cryptocurrency algorithm has outperformed this fiat model substantially over the past 12 months.

- The previous fiat exchange algorithm has captured our funds 70-120% per year, and our updated cryptocurrency algorithm has yielded much higher results in the last twelve months. ( See Our Financial Statements )

- Using crypto-tokens as a unit in the fund allows investors to take advantage or transfer ownership without the need of Countinghouse as an intermediary

Why Countinghouse

- Value - our ICO represents excellent value and is a great tool for improving social mobility, as traditionally, funds like ours will require an initial investment of over $ 300,000. Because of the decentralized and peer-to-peer nature of the ICO market, investors can invest as much or as little as they want. For example, an investor might only have a total of $ 1,000 in liquid capital to invest, which would normally exclude them from managed funds or venture capital. However, due to the progressive nature of the ICO market, these investors can diversify into separate ICO offerings, Countinghouse Fund and four others at $ 200. This gives these investors a diversified portfolio at previously inaccessible prices.

- Established - 90% of our existing business structure can be transferred to the crypto currency arm from our funds, which means more investor funds will be directly invested into our strategy. This means your capital will work directly with us, delivering potential results as soon as our crypto algorithm is activated.

- Experience - The benefits of Shelter Funds from experience combined for decades and the ability to tailor its merchants. Risk mitigation and mathematical trading algorithms have been developed in response to ever-changing foreign exchange market conditions, the same principles and algorithms that have now been adapted to crypto currency exchanges.

- Investment Security Priority - Crypto currency pegs will be stored in some purses for security purposes, where we will practically use cold hardware and wallets to enhance security (this will not always be practical because of the human element's needs). Countinghouse Funds will withstand fiat currency in non-borrowing, 100% bank liquidity, these banks have higher costs but they are the most secure global banks in the world, which will enable us to successfully trade arbitration between the crypto currency and fiat currency and provides substantial benefits to unlimited token holders imposed by banks in financial decline ( this can happen to lender banks as the need to protect their reserve limits ).

- Liquid - Ownership in ICO funds can be liquidated and acquired at any time, in small or large quantities as requested by investors, providing the Establishment Holder provides much greater market flexibility and response than is found in traditional shareholdings. This allows Countinghouse investors to enjoy a highly adaptable and highly liquid portfolio while holding our ICO tokens. It also allows immediate updates anytime from the value held by the investor.

- Our Token - Fund Token is a standard ERC20 token, which can be obtained globally

ICO Information

The Housing Fund token holder carries the following risks associated with crypto currency :

- Inherent risk-crypto currency based on market appraisal and potential losses associated with this, theft of currency token currency, compliance risk in relation to the laws of your country related to the transfer of tokens to fiat currency and finally the risk of misunderstanding and misunderstanding about the nature and mechanism crypto - currency and token. After the transfer of crypto currency to the ICO Countinghouse Fund, an investor acknowledges that all the risks inherent in ICO and the crypto currency are understood. The following is a list of potential risks attached to ICO crypto-currency :

- Countinghouse Fund puts no assurance that investor capital will generate profits

- All investments may be lost, like most investments in the financial world

- There is no government insurance mechanism for crypto currency

- The future of our token liquidity is not guaranteed

- Countinghouse Fund will take all reasonable precautions to protect investment and capital; there is still a risk of hacking and fraud attached to the crypto - currency. Just deal directly with Dana Countinghouse

- Governments may enforce unpredictable regulations or legal restrictions that affect our crypto - currency or investment

- There is a risk of loss caused by technical errors or damage

- There is a risk of devaluation of crypto and / or fiat currency

- Please review our legal agreement here, further describing all terms and agreements. It is expected that all investors have read, understand, and agree

ICO Structure

Countinghouse Fund aims to raise 20,000 ETH in Crypto-Currency to invest and actively trade Crypto-Currency in our funds

The value of our tokens will not only increase along with the increase in earnings of funds, but because of the desirable nature of having a Crypto product like ours that benefits from movements in the market ( meaning that even when the market is in declining state, our algorithm will force profit through movement ) there will be added value through speculation and market demand. This allows our investors to liquidate their holdings at any point, and given that most exchanges allow for automatic profit taking, investors can tailor our funds into various portfolios or investment strategies.

This model is attractive to investors because our high liquidity model allows a flexible and reactive investment strategy. In addition, it should be mentioned that investors can liquidate some of their holdings or wholly, allowing a more nuanced approach to profit. Investors will also be able to get an instant assessment of their share of our funds by checking the token prices on the exchange, unlike traditional funds where investors have to wait for periodic reports

The appeal of incorporating traditional hedge-fund fiat-exchange methodologies into modern Crypto-Currency exchanges is that proven financial performance transitions into the future of currency exchange, and the increase in trading volume currently provided. This will be an attractive offer for both new and traditional investors. Some ICOs can offer established businesses with proven workable products that can be acted upon immediately after the launch of ICO. This is exactly what our funds offer.

Unlike other ICOs, we do not have soft caps. The reason is that our existing investors from our fiat currency funds have purchased sufficiently purchased ICOs first to make them viable even without further investment. However, we have hard hats, this is to increase the desire of the units because they offer unlimited. We believe this will also increase speculative growth above the growth of the funds generated, this is of course very beneficial to our investors.

Pre-Sales Bonus and Initial ICO Investor

With the launch of the ICO Fundinghouse Fund we will offer a bonus structure that allows early investors and high capital investors to increase their holdings. The bonus structure is divided into the following two parts :

- Pre - Sales

Investors who choose to participate in ICO between April 3 and May 9 will be allocated thirty percent (30%) CHT bonus. This means that for every 1 ETH invested, investors will receive 1,300 CHT, whereas if this investment is made after the initial two weeks investors will be issued 1000 CHT for 1 ETH them. (Pre-sale cap 5,000,000 CHT)

- Initial Investor Bonus

Investors who choose to participate in ICO within the next 7 days after pre-sales will be allocated a fifteen percent (15%) CHT bonus. This means that for every 1 ETH invested, the investor will receive 1150 CHT, whereas if this investment is made after the first two weeks, the investor will be issued 1000 CHT for 1 ETH them. ( Initial investor bonus 5,000,000 CHT )

Countinghouse wants to encourage our investors to take advantage of this bonus offer so as to maximize their ownership and potential returns. This bonus is a good way to invest in the Countinghouse Fund for both short and long term investors.

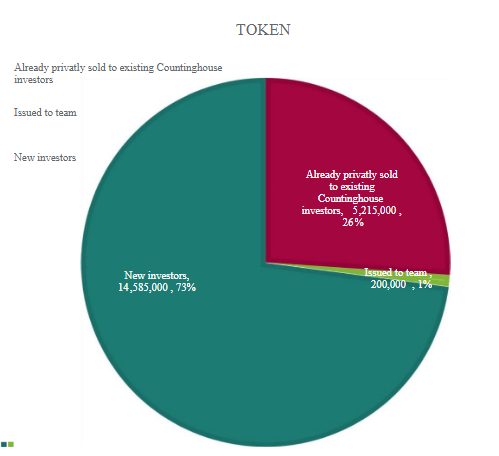

Allocation of Token

Allocation of Token Dana Penghun is very simple. We have personally sold 5,215,000 units to our existing Countinghouse Fund investors ( sold for 1200 CHT per 1 ETH, as per investor initial price ), raising more than 4,345 ETH ( about US $ 4.3 million at time of writing ). One percent ( 200,000 ) has been allocated to the team, we will keep it in storage for the first twelve months, then it will depend on each team member to decide whether to hold it in the long run or sell it. The remaining 14.585.000 CHT will be sold to new investors in our ICO sales, this will increase between 11,220 ETH and 14,585 ETH ( depending on available bonus ). It should look at the initial size of the fund up to about 18,000 ETH. Based on the results of last year, we should see the significant benefits generated from this account,

ICO Detail Overview

Token Token tokens will be offered on EthereumBlockchain ERC20, issued after the launch of ICO :

- 3 - April2018 : 0:00 GMT

- 12 - June2018 : 0:00 GMT

- Ticker : CHT

- Token - price : 1 ETH = 1000 token Electronic Money Counter ( CHT )

- Hard-Cap : 50 million CHT

Token Distribution of enhanced capital

- 10% Passive reserves ( Debentures and ICO investments )

- 30% Two-Side Arbitration Strategy

- 60% Crypto-Currency algorithmic trading

Note that because the Countinghouse Fund is already an established business, all funding will be used to generate profits immediately after the launch of our ICO, Countinghouse generates profit from the fund. 7% of the profit generated that month.

Token Fee

- All existing Countinghouse investors, and new investors who take advantage of our pre-sales

- ( 3rdApril to 9thof May ) will be issued 30% more tokens ( 1 ETH = 1300 CHT )

- The next 7 days will have an initial invertor bonus of 15% ( 1ETH = 1150 CHT )

- After the pre-sales and initial bonus period of investors, the rest of our tokens will be sold at 1 ETH = 1000 CHT.

If you would like to participate, visit our website at www.CountinghouseFund.com which will connect you to our ICO portal. Please only deal directly through us to avoid potential problems. For experienced Crypto-Currency traders, you can find our Smart - Contract

ROADMAP

- December 2008

3 Merchants combine efforts and form DPP, private partnerships to capitalize on economies of scale

- August 2013

Countinghouse formed due to high demand from investors for hedge funds run by a team in the capital of the DPP, using the technique of 'profit-from-movement' that can not be predicted.

- 2013 - 2016

Countinghouse consistently produces 70% -120% increase in PA. Attract more investors and fame in the professional investment community.

- January 2017

Countinghouse started a one-year experiment, using one of their fiat currency algorithms to trade BTC / USD

- Then in 2017

Countinghouse continues to investigate Crypto-market as their experimental success begins to become apparent.

- End of 2017

The results of this incredible experiment, Countinghouse began planning a new fund and ICO, along with developing a multi-faceted technique arbitration us to exchange crypto.

- Jan to Feb 2018

Countinghouse offers private sales to existing investors to join the new funds. Countinghouse collected more than $ 4.3 million for new funds.

- April 2018

The expected launch of ICO IC Fundinghouse.

- May 2018

ICO expires, funds are transferred to some wallets and accounts for trading. Trading begins as soon as funds are transferred

- May 2018

Several pairs to trade and stage one arbitration begins ( this is a simpler stage while opportunities exist )

- 2018 to 2019

Funds continue to be traded and our simple arbitrary opportunities involve second stage arbitration ( more complex and less detectable arbitrations )

- continously

Along with the growth of funds, we must continue to balance and spread to various exchanges to reduce slippage

The Countinghouse Team

Tim Dawson - Director, Quantitative Analyst

Dawson's team has backgrounds in programming, computer learning and math. Timemploys skills are very influential on the currency exchange market through three dimensional mathematical algorithms and expert coding. The team filters through the apparent market chaos to discover the underlying system that governs it.

Mike Pomery - Director of Operations

Mike Pomery has formal training in research, statistics, and psychology as well as extensive trade experience. A globally published author, Mike is our resident polymath who manages to apply his scientific skills to currency-exchange

Chris Yap - Physical Asset Advisor

Chris has experience in the financial and investment industries for many years. He has managed many property portfolios and manages projects of physical assets such as property development. While this is most relevant to the physical investment arm of the fund, Chris's suggestions on various aspects and nuances of the world's finances have been proven and will continue to be valuable to our funds and future profits.

Steve Pogacic Real - World Ethics Manager

Steve is one of the original members of our first trading fund, Dawson Pomery Pogacic Capital (DPP Capital), and his trading experience and insights remain useful for our current funds. NowSteve specializes in analyzing every proposed investment to ensure that there will be no unexpected negative consequences in the real world and in real people. The Countinghouse Fund will always return the highest yield, but not compromise the compromised ethics or morals.

Nathan Cooke - Head of IT Advisors and Director

Blockchain from Wisper Connect ( Partner-Channel )

Nathan is one of our channel partner directors, WisperConnect. He maintains an encrypted Internet connection Countinghouse Fund and our VPS trading, ensures double-redundancy on our online system and maintains state of the art encryption for our funds. This makes investment safe and secure. With years of experience, Nathan is also key in preparing Countinghouse for blockchain.

Justin Piro - Internet Security and Privacy Manager

Director of Wisper Connect ( Channel - Partner )

Justin is another director of our channel partner, Wisper-Connect. Justin ensures the encryption and protection of investor data, and helps us with data retention strategies. This makes the Countinghouse Fund a secure and reliable online presence for your investment.

Adam Hackett - Technical Support and Manager Relationship Director

from Wisper Connect ( Channel-Partner )

Adam is also one of the directors of our channel partner, Wisper Connect. He guarded the technical support side of the Countinghouse-Wisper relationship. Make sure we always have secure, secure access to our data, brokers, and networks.

Finance and Crypto Media

For detailed information about our ICO you can also visit our website address below from me and thank you :

- Website : http://countinghousefund.com/ico

- White paper : https://www.countinghousefund.com/whitepaper

- JN Thread : https://bitcointalk.org/index.php?topic=3406903.new#new

- Telegram : http://t.me/Countinghouse

- Facebook : https://www.facebook.com/Countinghouse-289073354768908/

- Twitter : https://twitter.com/CountinghouseFd

Article Writer : SyiefaQhollby98

BitcoinTalk : https://bitcointalk.org/index.php?action=profile;u=1407600

ETH : 0xA58315ebeC9c0032b9cc73D326041b004E27F5D7

BitcoinTalk : https://bitcointalk.org/index.php?action=profile;u=1407600

ETH : 0xA58315ebeC9c0032b9cc73D326041b004E27F5D7

Tidak ada komentar:

Posting Komentar